Deal Memo

Publication Date: 07/28/2025

| TLDR: Tix4 enters the $67.7B global ticketing market as DOJ's antitrust lawsuit against Ticketmaster heads to March 2026 trial, with 40 attorneys general seeking breakup of the ticketing monopoly. The company's hybrid physical booths + AI platform targets last-minute tourist demand, starting in Las Vegas (42M+ annual visitors) with expansion planned to NYC, Nashville, and beyond. Leveraging data showing 33% day-of ticket savings, Tix4 achieved $11.2M gross sales in 2024 and projects $160M+ by 2028. Led by Capitol Records/Caesars Entertainment veterans with multiple successful exits, Tix4 is well-positioned for explosive growth with an AI-first solution, a well-known brand, and foundational revenue in this rapidly evolving market |

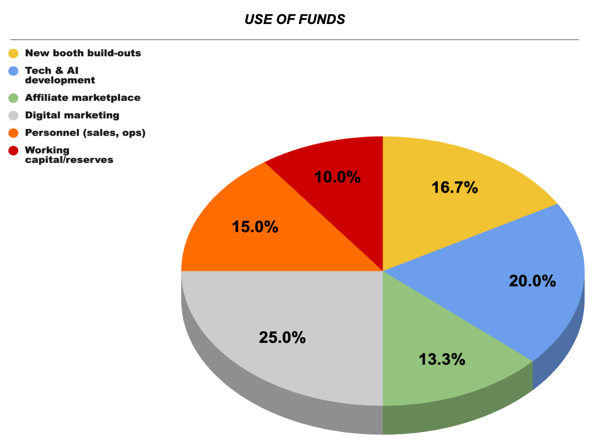

1864 Fund is leading Tix4's Series A round through our "Tix4 Investors" SPV. We're syndicating capital to propel this high-potential venture forward. Bolstering the effort, the State's SSBCI program will match our investment up to $1M, helping to complete the $6M financing round.

Why Tix4

Our due diligence highlights Tix4’s strong momentum and strategic positioning within the $10.5B U.S. retail ticketing market, focusing on last-minute tourist demand through AI-powered kiosks and a hybrid sales model. This approach enables Tix4’s physical booths to access a wide range of inventory across the retail box office, secondary resale, and emerging “value channel” markets. The online platform is initially focused on the box office channel, with plans to incorporate value inventory as the platform evolves, later introducing membership.

Tix4 is led by a seasoned team with deep entertainment industry experience, including prior leadership at Capitol Records and Caesars Entertainment. The company has shown promising early traction and is exploring expansion opportunities through its online platform in NYC, Nashville, and other high-tourism markets. Management anticipates scaling to $25M in sales as early as mid-2026, with a long-term view toward a potential IPO in late 2028.

By combining high-touch, location-based retail with scalable digital tools, Tix4 aims to improve customer access, lower operational overhead, and appeal to a growing network of entertainment partners. The timing is particularly compelling as the DOJ's antitrust lawsuit against Live Nation-Ticketmaster heads to trial in March 2026, with 40 attorneys general seeking to break up the ticketing giant's monopoly. This creates unprecedented opportunities for competitors like Tix4 to gain market share during a period of industry disruption. While subject to execution and market dynamics, Tix4’s differentiated model and leadership background suggest meaningful potential to reshape the live entertainment, tourism, and hospitality ticketing sectors.

Below are diligence reports and investment documentation for SEC Accredited investors and Nevada Certified Investors (NCI) ready to take advantage of this opportunity:

Founding Team

Darin Feinstein (Chairman): Entrepreneur Darin Feinstein founded Red Mercury Entertainment, a full-service ticketing, box office, and production company that serves casinos in Las Vegas. Currently, Red Mercury Entertainment controls and operates entertainment and theater venues. Mr. Feinstein, through Red Mercury, is also a co-promoter of many shows in Las Vegas with Caesars Entertainment, MGM, and Live Nation, which have included Jennifer Lopez, Britney Spears, Lionel Riche, Gwen Stefani, Aerosmith, Lady Gaga and several others at the Dolby Theater at Park MGM, Bakkt Theater at Planet Hollywood, and The Venetian. Mr. Feinstein is also an owner and producer of several tribute shows currently operating inside casinos in Las Vegas, including MJ Live (which has been running seven (7) days per week since 2010) and Purple Reign, a Prince Tribute show located at the V Theater at Planet Hollywood. Mr. Feinstein has approximately One Thousand (1,000) employees across various companies and has worked closely with casinos for over twelve (12) years. On the restaurant front, Mr. Feinstein is the founder and creator of El Dorado Cantina, an organic and GMO-free Mexican restaurant chain comprising multiple locations on the West Coast. The El Dorado Cantina concept originated in 2014 out of Darin’s concern that most ingredients used by restaurants contained heavy amounts of antibiotics, pesticides, and steroids. Sourcing high-quality ingredients is our highest priority. Every single vendor we work with was selected specifically based on the quality of their organic and GMO-free products. As El Dorado Cantina continues to expand across the country, each new management partner agrees to uphold our sustainable, organic, and GMO-free principles.

Darin Feinstein (Chairman): Entrepreneur Darin Feinstein founded Red Mercury Entertainment, a full-service ticketing, box office, and production company that serves casinos in Las Vegas. Currently, Red Mercury Entertainment controls and operates entertainment and theater venues. Mr. Feinstein, through Red Mercury, is also a co-promoter of many shows in Las Vegas with Caesars Entertainment, MGM, and Live Nation, which have included Jennifer Lopez, Britney Spears, Lionel Riche, Gwen Stefani, Aerosmith, Lady Gaga and several others at the Dolby Theater at Park MGM, Bakkt Theater at Planet Hollywood, and The Venetian. Mr. Feinstein is also an owner and producer of several tribute shows currently operating inside casinos in Las Vegas, including MJ Live (which has been running seven (7) days per week since 2010) and Purple Reign, a Prince Tribute show located at the V Theater at Planet Hollywood. Mr. Feinstein has approximately One Thousand (1,000) employees across various companies and has worked closely with casinos for over twelve (12) years. On the restaurant front, Mr. Feinstein is the founder and creator of El Dorado Cantina, an organic and GMO-free Mexican restaurant chain comprising multiple locations on the West Coast. The El Dorado Cantina concept originated in 2014 out of Darin’s concern that most ingredients used by restaurants contained heavy amounts of antibiotics, pesticides, and steroids. Sourcing high-quality ingredients is our highest priority. Every single vendor we work with was selected specifically based on the quality of their organic and GMO-free products. As El Dorado Cantina continues to expand across the country, each new management partner agrees to uphold our sustainable, organic, and GMO-free principles.

Andrew Shack (CEO): Andrew Shack is a highly respected entertainment industry veteran with a history of developing multimillion-dollar companies, shaping the careers of multiplatinum-selling artists, advising on blockbuster films, and producing vastly successful soundtracks. His achievements include being CEO and co-founder of the groundbreaking, celebrity-endorsed, and doctor-recommended hypnotherapy program The Kerry Gaynor Method®, and Mr. Shack was integral in growing the brand to what it is today as one of the most well-known programs helping people all over the world overcome addictions. Previously, Mr. Shack served as President at Priority Records and as an Executive Vice President at Capitol Records, where he managed an entire division. Career highlights include working with such renowned artists as N.W.A., Dr. Dre, Ice Cube, Coldplay, Paul McCartney, Pharrell, Snoop Dogg, Westside Connection, Wu-Tang Clan, among many others. Mr. Shack possesses a deep knowledge of entertainment marketing and a sharp instinct for developing pop-culture properties across multiple media platforms. His contributions extend to notable film soundtracks, including Friday (double platinum), Next Friday (platinum), I Got the Hook Up (platinum), Thicker Than Water, Three Strikes, and Rhyme & Reason(gold). He also co-executive-produced the comedy Who’s Your Caddy and produced a reality TV series for rapper DMX. He holds a BS/BA from Boston University’s School of Management and a Juris Doctorate from Whittier School of Law.

Andrew Shack (CEO): Andrew Shack is a highly respected entertainment industry veteran with a history of developing multimillion-dollar companies, shaping the careers of multiplatinum-selling artists, advising on blockbuster films, and producing vastly successful soundtracks. His achievements include being CEO and co-founder of the groundbreaking, celebrity-endorsed, and doctor-recommended hypnotherapy program The Kerry Gaynor Method®, and Mr. Shack was integral in growing the brand to what it is today as one of the most well-known programs helping people all over the world overcome addictions. Previously, Mr. Shack served as President at Priority Records and as an Executive Vice President at Capitol Records, where he managed an entire division. Career highlights include working with such renowned artists as N.W.A., Dr. Dre, Ice Cube, Coldplay, Paul McCartney, Pharrell, Snoop Dogg, Westside Connection, Wu-Tang Clan, among many others. Mr. Shack possesses a deep knowledge of entertainment marketing and a sharp instinct for developing pop-culture properties across multiple media platforms. His contributions extend to notable film soundtracks, including Friday (double platinum), Next Friday (platinum), I Got the Hook Up (platinum), Thicker Than Water, Three Strikes, and Rhyme & Reason(gold). He also co-executive-produced the comedy Who’s Your Caddy and produced a reality TV series for rapper DMX. He holds a BS/BA from Boston University’s School of Management and a Juris Doctorate from Whittier School of Law.

Carlos Reynoso (COO): Carlos Reynoso serves as the Chief Operating Officer at Tix4 and is a seasoned entertainment executive and principal at Red Mercury Entertainment, bringing over two decades of expertise to the dynamic world of live entertainment, including roles at Caesars Entertainment, AEG Live, and Goldenvoice. Formerly the Vice President of Citywide Entertainment for Caesars Entertainment, he curated and managed an impressive array of shows, featuring renowned artists such as Prince, Luis Miquel, Jerry Seinfeld, Elton John, Celine Dion, Barry Manilow, Jersey Boys, Bette Midler, Shania Twain, and many other high-profile acts. In his current role, Carlos oversees operations at Red Mercury Entertainment and Tix4, where his wealth of experience contributes to the company's strategic vision, growth, and success.

Carlos Reynoso (COO): Carlos Reynoso serves as the Chief Operating Officer at Tix4 and is a seasoned entertainment executive and principal at Red Mercury Entertainment, bringing over two decades of expertise to the dynamic world of live entertainment, including roles at Caesars Entertainment, AEG Live, and Goldenvoice. Formerly the Vice President of Citywide Entertainment for Caesars Entertainment, he curated and managed an impressive array of shows, featuring renowned artists such as Prince, Luis Miquel, Jerry Seinfeld, Elton John, Celine Dion, Barry Manilow, Jersey Boys, Bette Midler, Shania Twain, and many other high-profile acts. In his current role, Carlos oversees operations at Red Mercury Entertainment and Tix4, where his wealth of experience contributes to the company's strategic vision, growth, and success.

John Emmons (CSO): John Emmons is an accomplished strategist and operator with deep experience in venture growth, mergers and acquisitions, and capital formation. As Chief Strategy Officer at Tix4, he leads corporate strategy, investor relations, and long-term planning, playing a key role in shaping the Company’s expansion into both digital and physical ticketing channels. Over the past two decades, Mr. Emmons has contributed to and driven four successful acquisitions and one IPO, including strategic roles at Smalltown.com (acquired by Center’d), Tilt.com (acquired by Airbnb), Celery (acquired by Indiegogo), and Learn With Socrates (acquired by Education Revolution). He also supported growth initiatives and headed up sales and strategy, which led to the public offering of CafePress (NASDAQ: PRSS) with a market debut exceeding $100 million. Mr. Emmons brings a strong track record of aligning operational execution with investor outcomes and continues to drive Tix4 on strategic partnerships, product innovation, and public market readiness.

John Emmons (CSO): John Emmons is an accomplished strategist and operator with deep experience in venture growth, mergers and acquisitions, and capital formation. As Chief Strategy Officer at Tix4, he leads corporate strategy, investor relations, and long-term planning, playing a key role in shaping the Company’s expansion into both digital and physical ticketing channels. Over the past two decades, Mr. Emmons has contributed to and driven four successful acquisitions and one IPO, including strategic roles at Smalltown.com (acquired by Center’d), Tilt.com (acquired by Airbnb), Celery (acquired by Indiegogo), and Learn With Socrates (acquired by Education Revolution). He also supported growth initiatives and headed up sales and strategy, which led to the public offering of CafePress (NASDAQ: PRSS) with a market debut exceeding $100 million. Mr. Emmons brings a strong track record of aligning operational execution with investor outcomes and continues to drive Tix4 on strategic partnerships, product innovation, and public market readiness.

Go-To-Market Plan

Tix4's go-to-market plan is strategically phased to capitalize on its Las Vegas stronghold while scaling nationally through a combination of physical expansion, digital enhancements, and key partnerships. Starting from its current foundation of 8 locations and 6 API integrations—including Ticketmaster, AXS —the company plans to add 2 new locations and pilot an off-Strip kiosk within the next 6 months, supported by hyperlocal marketing to drive immediate foot traffic and spontaneous sales. Over the following 10 months, Tix4 aims to open 4 additional booths to reach 14 total, secure 4 more API integrations (such as Viator and OpenTable), and achieve $2M in monthly sales. This momentum builds into the next 14-18 months with the launch of influencer tools, further API locks (including RESY), and escalating sales targets to $2.5M-$3M monthly, setting the stage for broader market penetration in cities like NYC and Nashville.

The plan culminates in an IPO by Q4 2028, leveraging this hybrid model of AI-powered kiosks, online platforms, and affiliate marketplaces to dominate the last-minute ticketing space.

Traction

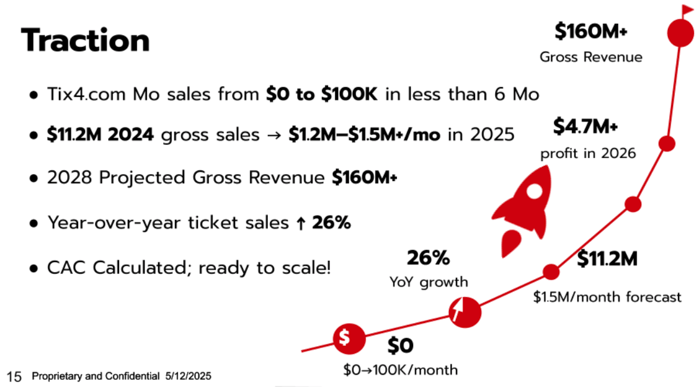

Tix4 has shown strong early traction since its relaunch—scaling online monthly revenue from zero to over $100K in under six months and generating $11.2M in gross sales for 2024. The company is currently tracking toward $1.3M–$1.4M in monthly gross sales in 2025. Ticket volume grew 26% year-over-year, with early customer acquisition cost (CAC) metrics suggesting the potential for efficient scaling as the platform expands.

Due Diligence Report

Click here to view full report

Market Background

Tix4 targets the retail ticketing segment within the broader live entertainment industry, focusing on last-minute, impulsive sales to tourists for shows, tours, and experiences through a hybrid model of physical kiosks/booths in high-traffic areas, an online platform (TIX4.com), AI-powered concierge services, affiliate/influencer API integrations, and bundled packages. Operations center on aggregating unsold inventory from primary issuers (venues, promoters) and reselling directly to consumers, with current emphasis on the Las Vegas Strip and expansion planned to NYC, Nashville, and multiple similar cities, scaling to 14 booths and $25M+ annual sales within 18 months.

The broader global live entertainment market is estimated at over $250B. Within this, the global TAM for online event ticketing specifically is $67.7B, with Tix4's immediate addressable market being the US SAM of $10.5B, calculated by summing estimated retail ticketing markets in target cities based on tourism volumes, entertainment spending, and ticketing shares:

- Las Vegas Strip ($2.5B): From $15B non-gaming revenue in 2023 (updated to reflect ongoing trends), with entertainment ticketing at ~$4-5B; assuming 50% for shows/tours/experiences yields $2-2.5B, and the Strip's 70% share supports adopting $2.5B for consistency, amid 42M+ visitors (2024).

- New York City ($5B): Broadway grosses ~$1.9B (2024-25 season), plus $3-4B from concerts/other events tied to $35.1B nightlife output, totaling $5B as a global hub with 64.1M projected visitors in 2025.

- Nashville ($1B): Conservative estimate for live music/tours/experiences from 17.3M projected visitors and venues like Grand Ole Opry/Bridgestone Arena (e.g., $35M+ in ticket sales mid-2025).

- Other Cities ($2B): Two markets akin to Nashville (e.g., Austin, Orlando), each ~$1B based on similar tourism and entertainment scales.

Market Timing

Tix4 enters the market at a pivotal moment. The Department of Justice, joined by 40 state attorneys general, filed an antitrust lawsuit in May 2024 against Live Nation-Ticketmaster, alleging monopolistic practices across the live entertainment industry. With the trial scheduled for March 2026 and the government seeking structural relief (breakup), this creates significant uncertainty for the incumbent while opening opportunities for nimble competitors. Consumer data shows 33% average savings on day-of ticket purchases, validating demand for last-minute solutions that Tix4's hybrid model addresses

Business Model

Tix4 operates a commission-based resale model tailored to capture last-minute tourist demand, centered around strategically placed physical ticket booths on the Las Vegas Strip, amplified by the website tix4.com, with plans to expand to NYC, Nashville, and beyond. The company earns revenue by securing unsold or discounted tickets from venues, promoters, and partners through affiliate or consignment agreements, minimizing inventory risk while selling directly to consumers for a commission, typically on same-day or next-day events.

This hybrid approach integrates an online platform (TIX4.com) for broader reach, enhanced by AI-powered concierge services and kiosks that streamline bookings and improve customer experience. Supported by high-visibility signage, LED posters, and a sales-driven team with aggressive incentives, Tix4 targets impulsive buyers, offering bundled destination packages to boost value, while leveraging API integrations and influencer partnerships to scale distribution and revenue efficiently.

Risks

- Vulnerability to Macroeconomic and Tourism Shocks: Tix4's heavy reliance on high-traffic tourist destinations like the Las Vegas Strip makes it susceptible to external disruptions, as evidenced by its mid-2021 bankruptcy filing amid the COVID-19 pandemic, which halted tourism and live events.

- Intense Competition in a Consolidated Market: The ticketing industry is dominated by giants like Ticketmaster/Live Nation, StubHub, and Gametime, with exclusive partnerships and scale advantages making penetration challenging. Tix4's D2C hybrid model, while differentiated, faces risks in scaling against these incumbents, particularly in securing inventory and undercutting prices without eroding margins.

- Execution Risk in Expansion and Tech Integration: Ambitious plans to expand booths, integrate multiple APIs, and achieve $25M monthly sales by 2026 hinge on careful execution, including AI kiosk pilots and influencer tools. Delays in these initiatives or failure to attract affiliate partners could hinder growth and necessitate additional funding.

- Regulatory and Competitive Disruption: While the DOJ antitrust case against Ticketmaster creates opportunities, it also introduces market uncertainty. Additionally, increasing regulatory scrutiny around fee transparency across the industry could impact pricing strategies and operational requirements.

Competitors

The competitive landscape in the live event ticketing market features dominant players like Ticketmaster (Live Nation), StubHub, and SeatGeek, controlling a significant share of the $50-80B global online market projected for 2025, driven by digital growth and recovery. Ticketmaster leads in primary ticketing with exclusive venue deals and online/mobile sales, but faces a DOJ antitrust lawsuit filed in May 2024 seeking a structural breakup, with trial scheduled for March 2026. The company lacks physical or AI-driven features. StubHub dominates secondary resale with global reach and dynamic pricing but operates online only, facing fee-related critiques. Gametime targets last-minute deals via mobile with strong user feedback but no physical presence. Vegas.com (Vivid Seats) offers Vegas-specific online bookings, while Viator (TripAdvisor) excels in tour/experience affiliates, both without kiosks or AI. Eventbrite serves smaller events with online ticketing and AI recommendations but lacks physical sales.

Register to Invest

About Us

Granite Partners and Ruby Partners operate the 1864 fund, FundNV, syndicate SPVs, and are for-profit venture capital funding partners with non-profit StartUpNV, Nevada's statewide business Incubator and Accelerator. FundNV invests in accelerator companies. AngelNV is an annual conference fund that educates new angels "how to" invest in Nevada startups. 1864 Fund is a seed fund focusing on startups in the American West. StartUpNV prepares early-stage companies for funding and accelerates them upon funding.

Contact Us

Las Vegas, NV 89101