Deal Memo

Publication Date: 06/24/2025

| TLDR: Tilt is disrupting the $6T freight market with AI-powered automation that solves critical industry pain points. The company has achieved strong early traction with $26M in 2024 revenue and a $70M TaaS pipeline in just 6 months. Led by experienced logistics veterans who previously scaled a brokerage to $1B+, Tilt's proprietary platform enables brokers to handle 4x more freight while reducing fraud and empty miles. |

1864 Fund is leading Tilt's growth round with a $500k investment. Through Tilt Investors SPV, we're pooling additional capital to accelerate the growth of this high-potential opportunity. The SSBCI program will match up to $750k in this round, complementing the $315k they matched in Tilt's 2024 seed round, which we also led.

Why Tilt

Our due diligence highlights Tilt's impressive momentum and strategic foothold in the $6T global land freight market, targeting digital brokerage and logistics with cutting-edge AI solutions. Led by a seasoned leadership team with deep industry expertise, Tilt has achieved $26.3M in revenue in 2024 and built a $70M GTV pipeline in just six months for its TaaS model. Their innovative, tech-driven platform enables efficient scaling, reduces operational overhead, and attracts a growing base of enterprise shippers and carriers. Tilt’s operational strength and market alignment set the stage for a $60M+ IPO within 12 months, indicating strong returns as they redefine freight logistics.

Below are diligence reports and investment documentation for SEC Accredited investors ready to take advantage of this opportunity:

Why Now: The freight industry is at an inflection point. Traditional brokers waste 40% of their time on manual tasks while facing rising fraud ($454M in 2024) and operational inefficiencies (35% empty freight runs). Digital solutions are rapidly gaining adoption, with the digital brokerage market projected to grow 30% CAGR to $37.5B by 2032. Unlike competitors focused on matching algorithms, Tilt built a comprehensive AI-powered platform that automates the entire freight lifecycle - from sourcing to execution to payment. Their proprietary computer vision and fraud detection give them a defensible moat in a commoditizing market.

Founding Team

Francesco Petruzzelli (CEO & Co-Founder): A dynamic veteran in creative technology, Francesco has pioneered AI/ML and adtech, entertainment, and gaming solutions. He has overseen multiple successful exits, leading a multi-billion-dollar industry and filing numerous tech patents in Europe and the US in his previous role.

Francesco Petruzzelli (CEO & Co-Founder): A dynamic veteran in creative technology, Francesco has pioneered AI/ML and adtech, entertainment, and gaming solutions. He has overseen multiple successful exits, leading a multi-billion-dollar industry and filing numerous tech patents in Europe and the US in his previous role.

Glenn DeWeese (President & Co-Founder): Glenn leads Tilt and is responsible for development, growth, and vision. With over 15 years of commercial experience, he has spent almost a decade in the transportation industry, including growing a brokerage from early revenues into a billion-dollar venture.

Glenn DeWeese (President & Co-Founder): Glenn leads Tilt and is responsible for development, growth, and vision. With over 15 years of commercial experience, he has spent almost a decade in the transportation industry, including growing a brokerage from early revenues into a billion-dollar venture.

Josh Holtom (COO & Co-Founder): Josh co-founded Tilt in 2021 and, in his role as COO, works to unify processes, increase operational efficiency, and integrate new solutions that enhance Tilt’s offerings. He previously worked in a brokerage that grew from $30 million revenues to over a billion.

Josh Holtom (COO & Co-Founder): Josh co-founded Tilt in 2021 and, in his role as COO, works to unify processes, increase operational efficiency, and integrate new solutions that enhance Tilt’s offerings. He previously worked in a brokerage that grew from $30 million revenues to over a billion.

Stephen Curran (CFO): Stephen brings over 15 years of finance leadership experience, having worked with high-growth businesses, including startups, private equity-backed companies, and listed entities. He joined Tilt with an operational and corporate finance/M&A space background.

Stephen Curran (CFO): Stephen brings over 15 years of finance leadership experience, having worked with high-growth businesses, including startups, private equity-backed companies, and listed entities. He joined Tilt with an operational and corporate finance/M&A space background.

Go-To-Market Plan

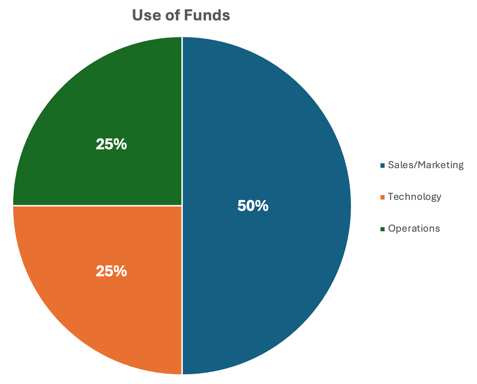

Tilt’s go-to-market strategy is focused on broadening its service offering and deepening platform utility across its existing customer base. Tilt is investing in high-impact capabilities that enhance the value of the platform. Core GTM initiatives include the launch of LTL and Drayage solutions, rollout of shipper-facing dashboards, and deployment of a free TMS for carriers to drive adoption and retention. The company is also building AI-driven tools—including autonomous agents to source market capacity, rate negotiation, and complete back-office tasks—designed to boost agent productivity and operating margin. Advanced analytics, automation, and system integrations are central to enabling scalable, tech-led growth. Proceeds from the raise will be allocated primarily to product development and AI enablement, with key hires as well in Marketing, Sales and support function positions to ensure growth is supported by efficiency and customer satisfaction.

Longer term expansion plans are focussed on a Q3 2026 European launch with Asia to follow in 2027.

Traction

Risks

-

Competition and Margin Pressure: Tilt operates in a crowded market with giants, facing potential margin erosion as competitors leverage scale and established networks, particularly as marketplace revenue growth is projected to slow from 52% (2024-2025) to 13% (2026-2027).

-

Cash Flow Strain from Factoring Dependency: The brokerage model’s working-capital intensity requires factoring at a 2% cost, with projected interest expenses rising from $884K in 2025 to $2.7M by 2027, posing risks if payment delays or disputes increase, potentially impacting liquidity.

-

High Operating Expense Growth: Operating expenses are projected to nearly quadruple from 2024 to 2027, driven by salaries and technology investments, which could outpace revenue growth if client acquisition falters in a competitive landscape.

Due Diligence Report

Click here to view full report

Market Background

The global freight and logistics market is enormous and growing. Industry analysis projects the total market at $6.4 trillion in 2025, rising to $8.1 trillion by 2030 (5% CAGR). Road freight alone accounts for a large share – roughly $2.2 trillion globally today. With an average margin of 18%, a technology brokerage like Tilt has about $396 billion of total market potential.

Tilt’s serviceable market is a subset: the digital freight brokerage and land-logistics segments. The digital freight brokerage space is currently around $5.9 billion worldwide, but forecast to skyrocket to $37.5 billion by 2032 (~30% CAGR) as shippers and carriers adopt online platforms. The broader logistics software market (including transport management systems, visibility/analytics tools, etc.) is also substantial ($29.5 billion in 2025, 12% CAGR).

- Total Market (TAM) - $396 billion capturable road freight market

- Serviceable Market (SAM) - $35.4 billion digital brokerage + transportation logistics

Business Model

Tilt operates a technology-driven logistics platform with two primary revenue streams: the Capacity Marketplace and a Transportation-as-a-Service (TaaS) agent program.

The Capacity Marketplace is Tilt’s freight logistics platform, operating much like Airbnb — but for shipping. Instead of matching travellers to hosts, Tilt connects enterprise Shipping clients to a vast, integrated Carrier network, manages the shipment, ensures delivery and earns 20% of the cost of each shipment. This business line is currently the primary revenue driver, with growing traction from repeat enterprise clients who benefit from automation, transparency, and AI-driven pricing.

Tilt’s TaaS model supports independent freight agents using the platform to operate their own book of business. In this structure, Tilt provides the tools, technology, and carrier network, while agents handle customer relationships and freight execution. Revenue is generated through a profit-share model, where Tilt retains 6%+ of the cost of each shipment. This model is highly scalable, with rapid growth already underway with projections showing a rise from $261K in 2024 in profit to $10M by 2027 as the segment scales rapidly.

A future revenue opportunity lies in the launch of SaaS , where Tilt could monetize its freight management software directly. While this is not active today, the product has 90%+ gross margin potential if launched for brokers and carriers outside the Tilt ecosystem.

Product Roadmap

Tilt’s product roadmap is designed to solidify its leadership in the freight and logistics market, with a clear progression of enhancements and expansions over the next 24 months. In Q3 2025, the company will roll out advanced AI fraud detection and real-time emissions tracking features to its Capacity Marketplace, enhancing security and sustainability for enterprise shippers, while introducing a mobile TMS app for carriers to boost adoption. By Q1 2026, Tilt plans to launch an integrated warehousing module within the TaaS platform, enabling end-to-end logistics solutions and targeting a $100M GTV pipeline. The Q3 2026 milestone includes a beta release of the SaaS tools segment, offering premium analytics to brokers and carriers, contingent on market demand, as leadership evaluates its strategic fit. Culminating in mid-2027, Tilt aims to integrate fleet management capabilities and prepare for the $60M+ IPO on the London Stock Exchange (or another exchange), leveraging its experienced team to drive a unified ecosystem that scales efficiently across the market.

Competitors

Tilt operates in a rapidly evolving freight market where its core competition stems not from traditional asset-heavy carriers or legacy brokerages, but from two primary sources: freight technology providers & agent-based brokerage networks.

Large-scale agent model players like Armstrong Transport Group, GlobalTranz, and Mode Global offer independent agents access to operational infrastructure and negotiated carrier rates, while retaining a traditional brokerage foundation. On the other side, modern SaaS-based logistics platforms—such as Turvo, Project44, and Tai TMS—deliver tech-enabled tools including TMS, real-time visibility, and advanced analytics as standalone solutions. Tilt differentiates itself by combining the best of both worlds: offering agents and small brokerages a full-stack, AI-powered Transportation-as-a-Service (TaaS) platform that includes digital tools, back office support, and access to curated capacity—positioning itself uniquely as an end to end solution.

Register to Invest

About Us

Granite Partners and Ruby Partners operate the 1864 fund, FundNV, syndicate SPVs, and are for-profit venture capital funding partners with non-profit StartUpNV, Nevada's statewide business Incubator and Accelerator. FundNV invests in accelerator companies. AngelNV is an annual conference fund that educates new angels "how to" invest in Nevada startups. 1864 Fund is a seed fund focusing on startups in the American West. StartUpNV prepares early-stage companies for funding and accelerates them upon funding.

Contact Us

Las Vegas, NV 89101