Early-stage investing often feels complicated, risky, and reserved for insiders...

This leaves most people unaware of the wealth-building opportunities right here in Nevada. AngelNV provides the skills and support you need to confidently build a startup investment portfolio.

Earn Your Halo & Empower Your Portfolio

AngelNV makes startup investing straightforward with:

- Education: weekly sessions to learn the ins and outs of angel investing, so you feel confident and informed

- Access: a curated selection of Nevada’s highest potential startups, even after AngelNV5

- Community: join a network of like-minded investors making an impact on Nevada’s innovation economy

- Flexibility: be as active or passive as you want. AngelNV offers the experience to meet you where you are

At AngelNV, you’ll join a community of investors working together to fund Nevada’s brightest startups. Network, co-invest, and make an impact—together.

Join Nevada’s Thriving Angel Investor Network

Sign Up Now

.jpg?width=1367&height=911&name=DSC05041%20(1).jpg)

Without the Access, Tools, & Community...

Nevada's gold rush didn’t end—it evolved.

Today, the real gems are in our startups, and we’ve got the treasure map to help you find them

Instead of missing out on the next wave of high-growth opportunities or struggling through risky startup investments on your own, AngelNV helps you cultivate a diversified portfolio, make informed decisions, and shape Nevada’s future economy. We bring together aspiring investors, seasoned experts, and curated startups, empowering you to gain both financial returns and meaningful local impact. It’s more than just investing—you learn to invest smarter.

AngelNV, a program powered by StartUpNV, transforms curious newcomers into confident early-stage investors. The program offers hands-on workshops, expert-led training, and real-world deal analysis, empowering investors with the tools and confidence to make informed decisions. As the first angel group backed by pioneering Nevada legislation and the “Nevada Certified Investor” designation, AngelNV makes startup investing more accessible and inclusive than ever. AngelNV’s dramatically lower entry point—far below the usual $25k-$100k—means you can learn to invest confidently without tying up a large portion of your capital, still diversifying your portfolio with less at risk.

Investors can be as engaged or passive as they'd like. Many investors invest in AngelNV, without participating in the bootcamp. AngelNV is a great diversification opportunity. Other AngelNV investors participate in the entire process year after year, "because it's fun, we keep learning, and you make great friends". Whether you’re a seasoned participant or a new explorer looking to diversify your portfolio, our supportive community ensures that learning is fun, relationships are genuine, and returns are meaningful.

From the neon-lit nights of Las Vegas to the shores of Lake Tahoe, Nevada’s innovation landscape is yours to explore, and AngelNV ensures you’re not just watching from the sidelines, but helping to chart the course forward!

Who this program is for: First-time angel investors and experienced investors who are interested in growing their portfolio by investing in startup businesses.

Be part of Nevada’s entrepreneurial revolution—invest early, create impact, and shape the future with AngelNV.

.jpg?width=420&height=300&name=DSC00213%20(1).jpg)

AngelNV5 Investor Conference

January 14, 2025 - March 29, 2025

Submit this form, and feel free to book a call with one of our fund managers to answer any questions.

After completing your registration, you'll receive a Docusign to commit at least $5,000 investment and a one-time $500 fee. The investment is due by mid-program.

You can increase your investment amount (increments of $5k) at any time, up to the end of the finale. Each $5k= 1 vote for each final investment.

Investment capital is collected from angels between mid-February and March, and (optional) bootcamp sessions begin January 14th, 2025 on Tuesday evenings.

.

Over 11 weeks, angels learn the ins & outs of startup investing and evaluate the startups that have applied for funding.

By using the Dealum platform to review company applications, interacting with the founders, listening to pitches, and discussing as an investor group, the investors progress fewer and fewer companies through each round.

Angels ultimately narrow down the companies to a final 6 and break into teams, alongside fund managers & analysts. Each team completes deep due diligence on a finalist company, and report their findings weekly to the broader angel group and in a final report.

AngelNV culminates with a grand finale event, attended by the startup community, media, founders, and investors at City Hall in Las Vegas on March 29th, 2025.

Finalist companies pitch to the audience, and attendees network, enjoy a cocktail hour, featured speaker, and lunch. AngelNV5 investors deliberate in private after hearing the final pitches, casting their votes for how their pooled investments will be awarded (invested) amongst 1-3 winning companies.

Giant checks are presented to winning companies, and investors celebrate at a VIP after-party for Angels & their guests!

Program Sessions & Schedule

This tentative schedule assumes most meetings will occur on Tuesday evenings. A poll will be taken of the investors to confirm or change the weekly meeting days and times. Attend in person in Las Vegas, or virtually via zoom. All weekly sessions are recorded and made available to all registered investors by an unlisted / private link on our YouTube Channel. Each session kicks off with a short lesson on topics critical to investing in startups.

Intros, Team Assignments, Process Explanation, Dealum Intro - Tuesday, January 14, 2025

Initial Reviews, Team Meetings, Company Assignments - Tuesday, January 21, 2025

3-Minute Pitches, Straw Poll, Vote Due by Friday - Tuesday, January 28, 2025

10-Minute Pitches, Straw Poll, Vote Due by Friday - Tuesday, February 4, 2025 and Thursday, Feb 6

Discussion and Finalist Selection, DD Team Assignments - Tuesday, February 11, 2025

DD Team Findings & Reports - Tuesday, February 18, 2025

DD Team Findings & Reports - Tuesday, February 25, 2025

DD Team Findings & Reports - Tuesday, March 4, 2025

DD Team Findings & Reports - Tuesday, March 11, 2025

DD Team Findings & Reports - Tuesday, March 18, 2025

DD Reports Due by Noon - Monday, March 23, 2025

DD Discussion and Straw Poll - Tuesday, March 25, 2025

Finale Event - Saturday, March 29, 2025

Why AngelNV?

StartUpNV & AngelNV were founded by entrepreneurs that had built and exited multiple startup companies. They'd each relocated to Nevada from other hubs, including Austin, Bay Area, and Seattle. Upon looking to start another endeavor, these entrepreneurs found that Nevada didn't have a single startup accelerator, incubator, or early stage fund-- resources that were integral to their prior startups' success, and anything but scarce in the other states they'd lived in. Additionally, these founders looked to invest a portion of their success, both with investment capital and mentorship, into early-stage startups in the community- a key component of the virtuous cycle of entrepreneurship, and a major wealth-building opportunity. Thus, StartUpNV was created to power a state-wide startup ecosystem for startups to launch, scale, and thrive in Nevada. AngelNV is one of the many programs designed by StartUpNV to diversify Nevada's economy and attract the capital to keep Nevada's best and brightest building here at home, instead of another state's economy benefiting from their success. AngelNV demystifies startup investing and builds a virtuous community of like-minded individuals looking to power the next great innovations.

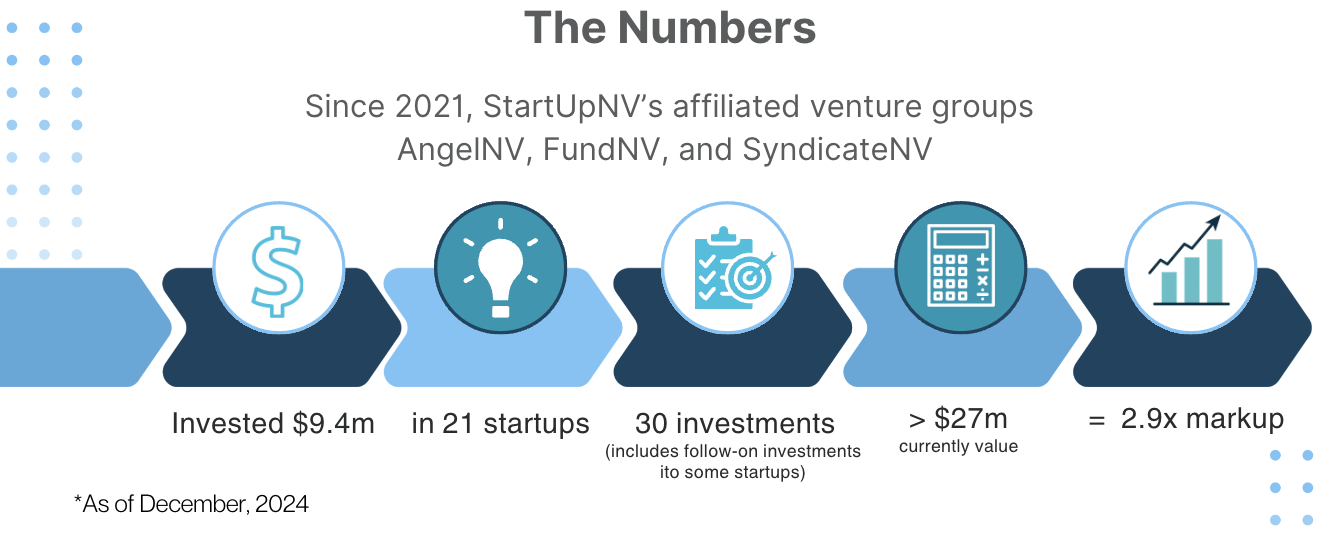

Of the 21 Startups We've Invested In

- 1 has shut down operations - this is part of the startup journey, many will fail (this time)

- 14 are progressing towards scaling their company

- 5 have returned capital (returned capital and/or stock to investors as a result of a liquidity event such as a merger, acquisition, or public offering)

- 2 have liquidity events in progress... stay tuned!

Hear from an Angel

Angel's Angle on AngelNV

"I first heard about AngelNV at the poker table through what is now a dear friend of mine, Lenny Barshack. Having made a living as a professional gambler my entire adult life the idea of taking a chance on early stage startups appealed to me.

What I did not expect was the fantastic community of fellow investors that would become my friends and mentors over the past 3 years. AngelNV 5 will be my 4th time participating and each year I feel like I get more out of the experience than the year before.

I highly recommend the program, not only to those interested in angel investing, but for anyone looking to connect with like minded individuals who love to learn and grow." - Josh C.

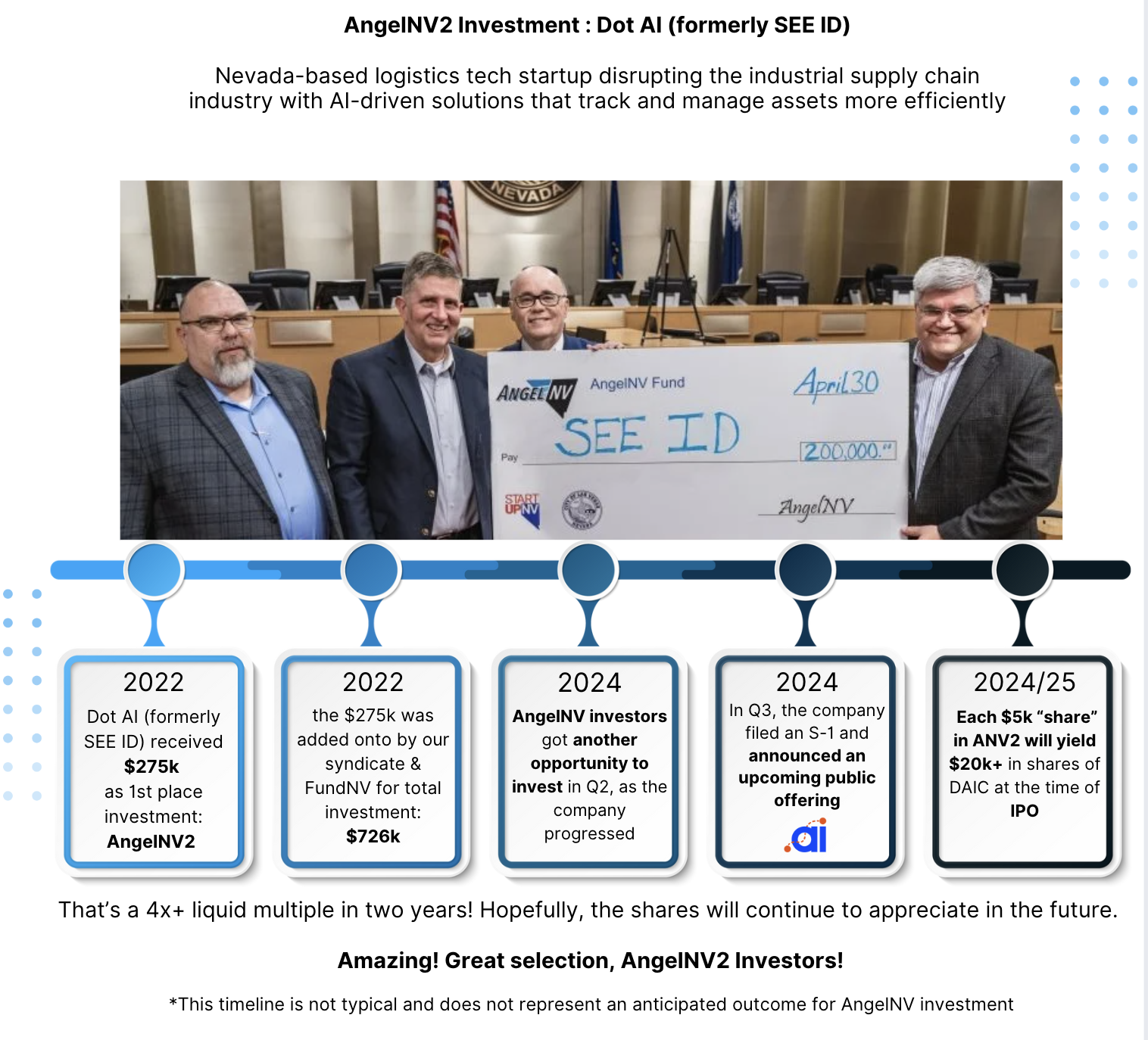

AngelNV Investment Case Study & Update

Register for the 2025 AngelNV Investor Conference

More Information: Earning Your Halo as an AngelNV Investor

AngelNV

Deeper Dive

The AngelNV Conference starts with a 6-week Entrepreneur’s Track in the Fall, prior to the Angel Investor Track, to prepare companies and provide sufficient deal flow. For AngelNV5, those companies submit complete profiles through December 13, 2024 for investor review beginning on January 14th, 2025. Investors will review 50+ applications and continue to narrow the field until the AngelNV Conference awards an investment on March 29, 2025. After multiple rounds of pitches and complete due diligence, a final winner will be selected by participating angels to receive the investment.

The AngelNV program is operated in partnership with StartUpNV, a 501(c)3, Nevada's statewide startup incubator and accelerator. StartUpNV is ground zero for all things startups in Nevada, providing 7+ free educational programs for founders, community events and expertise, mentorship, resources, and access to capital. Through StartUpNV, we receive top quality dealflow and insights of emerging startups and provide ongoing guidance and support to any Nevada-based startup.

With pooled resources and shared due diligence, participants gain access to quality, vetted startups, and learn how to properly evaluate companies and negotiate deals alongside experienced investors. The 11- week Investor Bootcamp include resources, weekly (optional) educational sessions and evaluation discussions, recordings, and a few investor mixers throughout. With (optional) weekly meetings, held in person in las Vegas and on Zoom, investors learn important fundamentals such as valuing a company, evaluating market size and opportunity, and due diligence on team, IP, product, financials, and more.

Investors can be as engaged or passive as they'd like. Many investors invest in AngelNV, without participating in the bootcamp, year after year because they have confidence in the investments AngelNV makes. Many prior AngelNV investors also participate in the entire process year after year, "because it's fun, we keep learning, and you make great friends".

Angel investments can provide non-correlated returns, meaning they perform independently of stock market volatility. A 5-10% allocation to alternative investments like venture funds is often recommended for high-net-worth individuals (HNWIs) to enhance portfolio resilience. Startup investing is high-risk, and higher potential returns. Startups, especially in high-growth industries, can generate returns far exceeding traditional investments. For instance, average venture capital returns range from 20-30% IRR (internal rate of return) over a fund's lifecycle, compared to 7-10% average annual return for the S&P 500. AngelNV is making history as the first angel group in the country to enable greater access and inclusivity in startup investing.

Nevada has passed FIRST-IN-NATION legislation to increase access to this asset class, qualifying many more Nevadans than the SEC’s accredited investor definition. Plus, while most venture funds or angel investments require an individual investment of at least $25-100k, AngelNV lowers barriers, enabling more individuals to participate with smaller checks (as low as $5k investment!).

Nevada Certified Investor: Any Nevada resident who earns $100k+ ($150k for a couple) in W2 annual income -or- any Nevada resident with a business (1099 or Schedule C) that has gross sales of $200k/yr or more may invest up to 10% of their net worth in Nevada companies.

AngelNV lowers the barriers to entry for early-stage startup investing. Investors have the opportunity to gain the skills and confidence necessary to evaluate, support, and invest in startups while minimizing risk and increasing the probability of additional investments. While many investment funds require a $50-100k investment minimum, and most startups require a minimum of $25-50k from any angel or fund, AngelNV invites investors to participate at only a $5k minimum investment. With this investment, their funds are distributed in 2-3 companies and begin to build their portfolio at a comparatively low risk.

Investors are empowered to continue investing with our other funds, future AngelNVs, or other investment avenues and remain part of our StartUpNV Community. Our first-time investors grow to be part of the state-wide Nevada ecosystem, form their own investment funds/groups, and join other organizations like FundNV, Reno Seed Fund, Sierra Angels, and others.

Founders who are not seeking investment from AngelNV also have a unique opportunity. With the deep experience, low investment minimum, and condensed timeline of this program, founders can become Angels, and invest and gain insights from “the other side of the table” about what investors want and are looking for.

AngelNV is an official partner of the SSBCI matching program- any investment the AngelNV investor group makes will be matched dollar-for-dollar by the state of Nevada!

The spirit of Nevada lives in the grit of its miners, the resilience of its ranchers, and the ingenuity of its entrepreneurs. Home means Nevada... invest at home with AngelNV.

$5,500/unit

- $5,000 of unit cost is invested.

- The remaining $500 tax-deductible donation is billed separately by StartupNV (a 501c3 non-profit) and covers program operation costs, Nevada Blue Sky state fees, and fund set-up and administrative costs for the life of the fund (7 years).

- Additional units cost $5,000 (limit 4). No admin fees or donations on additional units.

- Active units have full voting rights - 1 vote per active unit. Four (4) votes max - even with five (5) or more units.

- An extra one-half voting unit is awarded to diligence team leaders and fund administrators for the additional work required.

- Investors domiciled outside of Nevada may incur additional Blue Sky fees for their states ($300 to $500 for most states.)

- Fees also include access to AngelNV Investing Bootcamp, ACA Membership, and two (2) finale event tickets.

Frequently Asked Questions (FAQ)

About StartUpNV

Our mission is to attract, educate, and grow scalable Nevada startups.

StartUpNV is a Nevada 501(c)3 organization focused on entrepreneurship, economic development, and diversity across the state. We offer programs aimed at supporting early-stage entrepreneurs including, a business incubator, pre-seed startup accelerator, and early-stage venture fund. The funds associated with StartUpNV are some of the most active funds in the state, investing in Nevada-based startups.

Want to stay informed on upcoming StartUpNV Events?

Subscribe to Our Newsletter

About Us

StartUpNV is Nevada's statewide business Incubator and Accelerator. FundNV, AngelNV, 1864 Fund, IncubateNV, and Incubate Vegas are programs of StartUpNV. FundNV invests in accelerator member companies. AngelNV is a single special purpose vehicle for educating new angels to invest in Nevada startups. 1864 Fund is a seed fund that focuses on startups in Nevada and the Mountain West. IncubateNV and Incubate Vegas programs work with early stage companies, not yet ready for funding.

.png?width=200&height=85&name=StartUpNV%20-%20blue%20200x85%20(corner).png)

.png?width=2000&height=1000&name=AngelNV%20Graphic%20Lander%20(3).png)