A $2M pre-seed fund focused on scalable Nevada startups

Fund NV 2 | Investment Memo

Ruby Partners is launching FundNV 2 (FNV2), a $2M pre-seed venture fund based in Las Vegas, NV. FNV2 will fund early revenue capital-efficient Nevada-based startups focused primarily on B2B and enterprise solutions. We will invest $100k each in 20 (or more) companies over 24 to 36 months. All companies receiving investment must participate in the affiliated non-profit, grant-funded StartUpNV accelerator to ensure optimal performance and provide access to resources, mentorship, etc.

FNV2 investments will be matched 1:1 by the State of Nevada’s SSBCI program with the US Treasury Department. Matches are guaranteed (up to $3M) and are an equity investment at the same terms as FNV2. FNV2’s predecessor, FNV1 made 12 such joint investments in 2022-23.

Fund Target

$2,000,000Fees

2% Management20% Performance

Minimum Investment

$10,000Investor Criteria

Federally AccreditedNevada Certified

Pre-Seed Opportunity | Fund Thesis

FNV2 invests in “early revenue” companies with between $5k and $25k of monthly sales. We have a strong preference for contracted recurring revenue. We make our investment deals case-by-case through SAFE’s and priced preferred rounds. We focus heavily on the market size of the problem space, founder-market fit, and entry valuation to best ensure a 40-50x per company return (including likely dilution). We understand and expect that the Power Law will be in play with our fund - and therefore, our fund return goal is 3x (minimum) to 5x (expected) with a stretch goal of 7x or more within 10 years.

FNV2 does not reserve for follow-on from within the fund, preferring to use SPV’s and/or “sister” funds to follow-on in companies meeting or exceeding expectations. LP’s are offered positions in 100% of the follow-on SPVs with separate deal memos citing performance, reasoning, and analysis for each proposed follow-on investment.

We de-risk our investments with a requirement that companies participate in the 13-39 week accelerator program with partner StartUpNV. Accelerator participation guarantees a 1:1 funding match from the State of Nevada within 60 days - plus other critical resources, to best ensure success. Our goal is to have portfolio companies attain $100k+ of MRR within 18 months of initial pre-seed investment - with an additional seed round, if appropriate - in preparation for an A round with a significant mark-up to both pre-seed and seed rounds.

With an outstanding general business environment, low regulations and taxes, strong and improving universities graduating technical talent, and very supportive state and local governments aimed at diversification of the local economy, Las Vegas, Reno, and Nevada generally are poised for growth. FNV2 is central to this growth, with strong connections in the startup, university, and government communities. FNV2, StartUpNV - and our sister funds are foundational components in Nevada like YC is in Silicon Valley. With many founders and companies fleeing high-cost centers in California and elsewhere, Nevada is primed to rise - and FNV2 is optimally positioned to take full advantage at the pre-seed stage.

A Track Record to NV

FNV2 will follow the positive patterns of its predecessor $1M pre-seed fund (FNV1), AngelNV annual conference funds 1-4, and our ~300-person syndicate who invested with us from late 2020 thru early 2024.

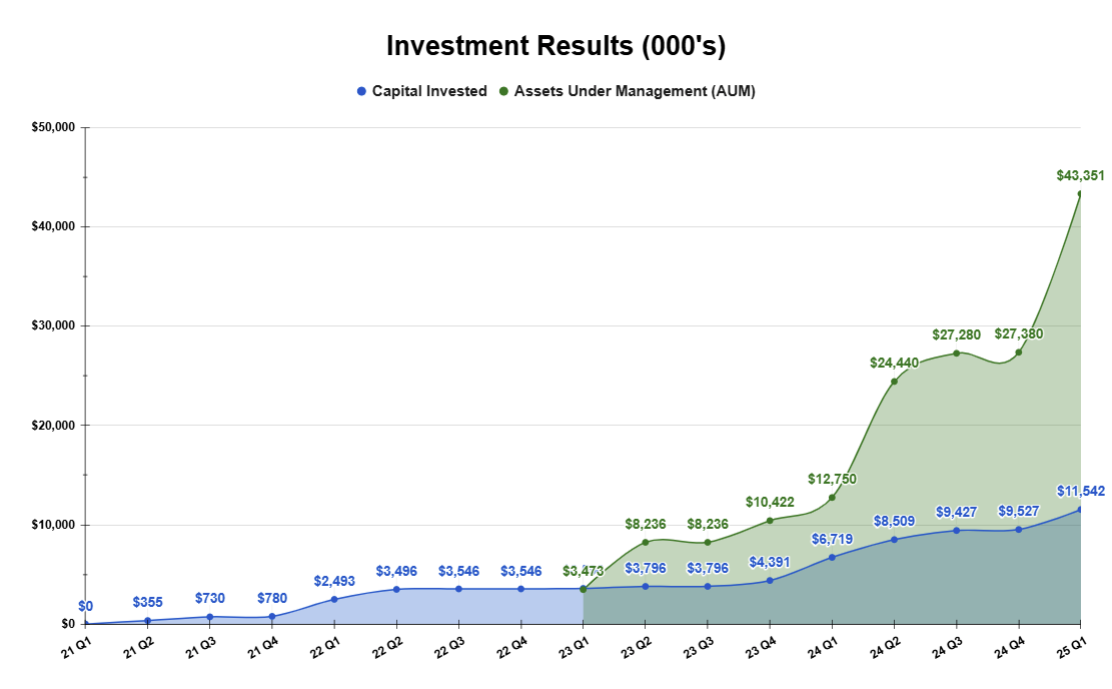

In that time, we completed 36 transactions - investing $8.5M of our own directly raised capital in 25 companies. ($28.9M in total including following partners and state-matched investments). The May 1, 2024 value on our directly invested $8.6M portfolio is $24.6M creating a MOIC ratio of 2.9x.

The chart below shows our direct investing history and current portfolio valuations, including mark-to-market adjustments down when companies stumble or fail - and up when unrelated venture firms invest at higher valuations. All market adjustments are post-ZIRP.

Fund NV 2 | Ruby Partners

Ruby Partners are Kristin Tomasik, Vicki Zhou, and Jeff Saling. Kristin and Vicki are Las Vegas natives and successfully exited technical co-founders. Jeff is also an exited (sales-focused) founder with additional complimentary roles in the Nevada startup community.

Interested In Investing?

Legal Formation

FNV2 is formed as a Nevada series LLC and is managed by, General Partner (GP), Ruby Partners LLC. Limited Partners (LP) will be members of the FNV2 LLC and will own a pro-rata share of the fund. Fund fees are the industry standard 2/20. FNV2’s unique partnership with non-profit economic development and education-focused StartUpNV allows for some fund management functions to be covered by SNV personnel funded by economic development grants – keeping fund costs low.

Investment range is $10k (min) to $400k (20% of the fund - max). Accredited Investors, Qualified Purchasers, and Nevada Certified Investors may invest.

About Us

FundNV partners with StartUpNV, a premier destination for founders and startups, both within Nevada and for those making the move to our vibrant state.

Through our partnership with StartupNV, FundNV has unparalleled access to the best startups and investment opportunities in Nevada.

LEARN MORE