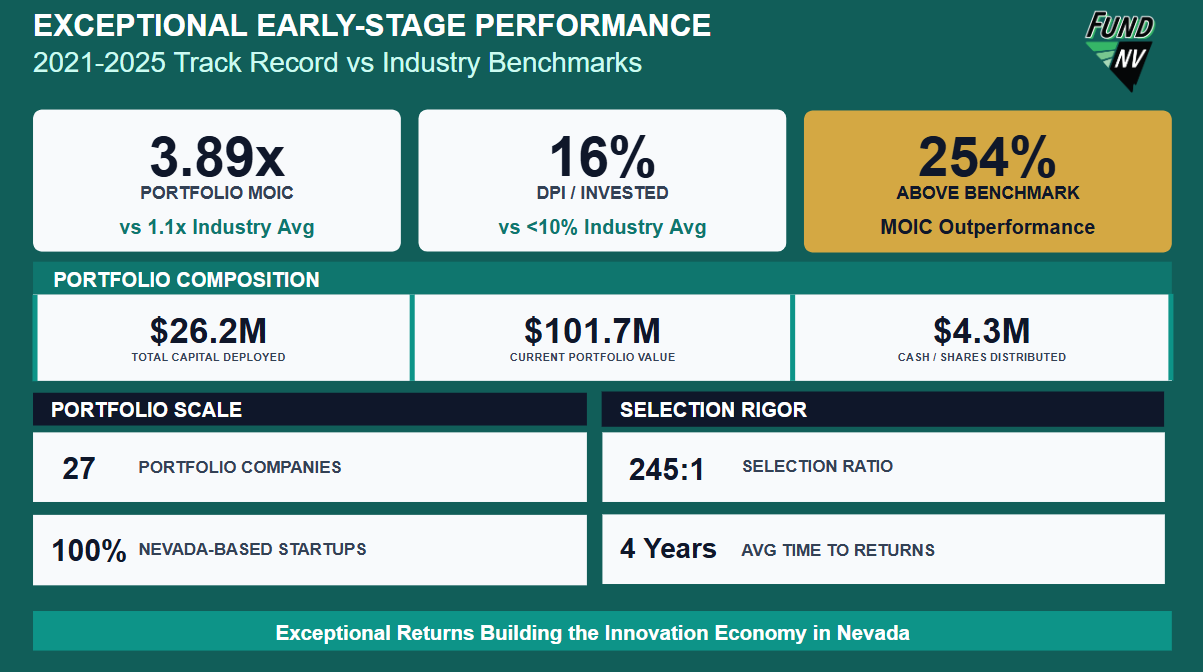

Top 1% Pre-Seed Fund Performance

Capital Efficient B2B / Enterprise fund investing in Nevada's emerging tech ecosystem with proven 3.34x returns and 30% distributions - in just 4 years

3.89x

Portfolio Returns

16%

Already Distributed

4 Years

Average Time to Returns

A Track Record to NV | $14.3M -> $47.6M

While 90% of 2021-vintage funds show zero distributions, we've already returned 30% to LPs with significantly more in the pipeline.

Portfolio Momentum

Voltaire

Turning 30-minute insurance claims letters into 30-second AI-powered outputs with 200%+ first-year ROI. (voltaire.claims)

BuildQ

AI-powered project intelligence platform reducing M&A timelines by 40% for renewable energy developers - cutting contract review time by 30%. (buildq.ai)

Listening Post

Multiplayer AI™ deploying intelligent agents in the Business Logic Layer - 27,000+ teams ready to transform organizational intelligence (listeningpost.ai)

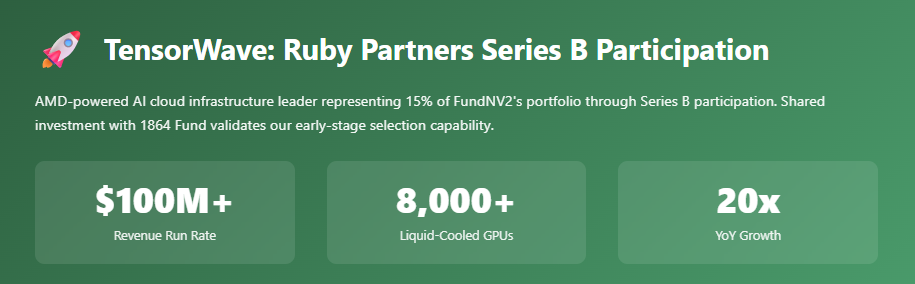

Tensorwave (15%)

AMD-powered AI cloud with 8,000+ liquid-cooled GPUs delivering breakthrough performance-per-dollar at $100M+ run rate (tensorwave.com)

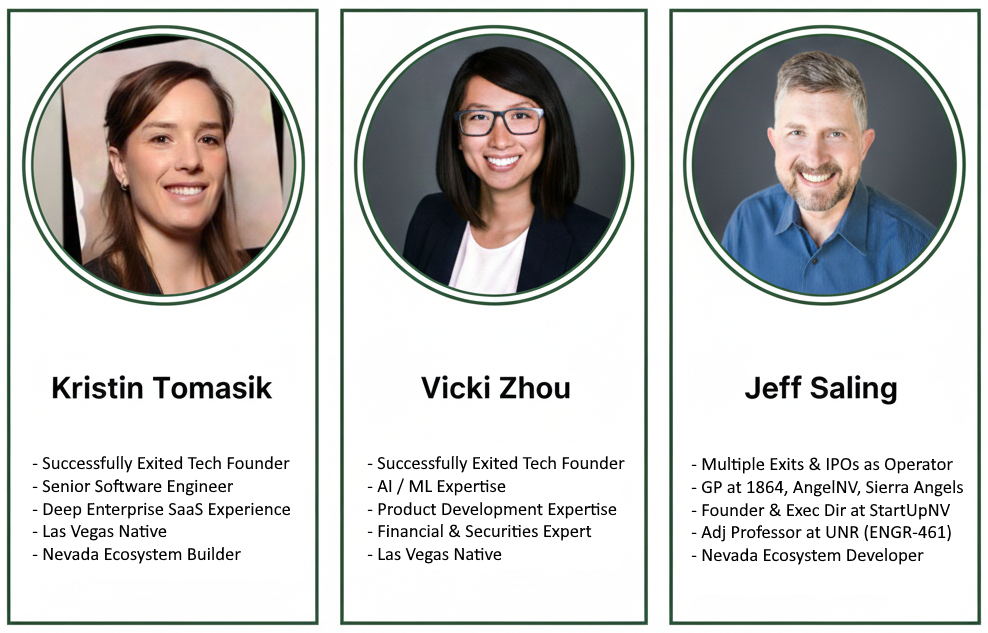

Ruby Partners: Operators, Not Tourists

Ruby Partners are Kristin Tomasik, Vicki Zhou, and Jeff Saling. Kristin and Vicki are Las Vegas natives and successful technical co-founders. Jeff is also an exited (sales-focused) founder with additional complimentary roles in the Nevada startup community.

Why Invest in FundNV 2?

Six compelling reasons to join Nevada's highest-performing pre-seed fund

Pre-Seed Opportunity | Fund Thesis

FundNV targets "early revenue" companies ($5k - $25k MRR) at entry valuations enabling 50x returns (including exepected dilution)

De-Risk Strategy

Limited Time Opportunity

FNV2 is raising its final $2M. LPs committing before closing have full ownership in existing positions. Join a partnership with a proven 3.34x track record and immediate exposure to Nevada's fastest-growing tech companies.

With Tensorwave participation representing 15% of the fund and two shared investments with the successful 1864 Fund (Voltaire + Tensorwave), investors gain exposure to a diversified portfolio of early-revenue companies positioned for 50x growth (with MFN, pro-rata, anti-zombie protection, etc.)

Fund Target

$2,000,000

Minimum Investment

$10,000

Target Close

Q2 2026

Follow-On Approach

FundNV2 does not reserve capital for follow-on investments within the fund. Instead, we use SPVs and sister funds to support proven performers. 100% of LPs receive access to all follow-on opportunities with separate deal memos citing performance, reasoning, and analysis.

Example: Our TensorWave Series B participation (~15% of fund) demonstrates this approach in action

Nevada is Poised for Growth

With an outstanding general business environment, low regulations and taxes, strong and improving universities graduating technical talent, and very supportive state and local governments aimed at diversification of the local economy, Las Vegas, Reno, and Nevada generally are positioned for explosive growth.

FundNV2 is central to this growth, with strong connections in the startup, university, and government communities. FundNV2, StartUpNV, and our sister funds are foundational components in Nevada—like YC is in Silicon Valley. With many founders and companies fleeing high-cost centers in California and elsewhere, Nevada is primed to rise—and FundNV2 is optimally positioned to capture value at the pre-seed stage.

FNV2 is formed as a Nevada series LLC and is managed by the, General Partner (GP), Ruby Partners LLC. Limited Partners (LP) will be members of the FNV2 LLC and will own a pro-rata share of the fund. Fund fees are the industry standard 2/20. FNV2’s unique partnership with non-profit economic development and education-focused StartUpNV allows for some fund management functions to be covered by SNV personnel funded by economic development grants – keeping fund costs low.

Investment range is $10k (min) to $400k (20% of the fund - max). Accredited Investors, Qualified Purchasers, and Nevada Certified Investors may invest.

About Us

FundNV partners with StartUpNV, a premier destination for founders and startups, both within Nevada and for those making the move to our vibrant state.

Through our partnership with StartupNV, FundNV has unparalleled access to the best startups and investment opportunities in Nevada.