Deal Memo | Issuance of Nasdaq-Listed Securities

Publication Date: 03/15/2025

| TLDR: The rapidly evolving $3.5 trillion Industrial Logistics and Asset Management market creates a massive opportunity for Dot Ai's next-gen AI-powered platform. Dot Ai offers disruptive logistics and asset tracking solutions, combining patented asset and workflow management technologies to deliver real-time, actionable insights. With $4.2M in bookings in 2024 and early enterprise traction, Dot Ai is poised for substantial growth. Dot Ai’s experienced management team and proven patented technology, coupled with early traction with enterprise customers like Wurth, suggest a clear path to market leadership. |

DAI Investors, a Series of StartUpNV Master LLC, is leading the Dot Ai bridge PIPE round, pooling up to $10M through a syndicated SPV. This investment provides access to Dot Ai shares at the established SPAC offering price of $10 per share, with additional bonus shares allocated based on total capital raised: investors will receive bonus shares that effectively result in (a) a $5.00 per share equivalent entry price if the SPV raises less than $1M or (b) a $4.00 per share equivalent entry price if the SPV raises over $1M. Purchased and bonus shares will be distributed to investors following the 1.) completion of the business combination and 2.) completion of the S-1 registration statement, which is estimated to take 45-75 days. IMPORTANT: This means that you will not have shares on the first day of trading. Stock prices change and could go down before your shares are available to trade. With streamlined administrative fees and no carried interest, this bridge PIPE round supports Dot Ai's strategic expansion plans while providing investors with defined participation terms in the upcoming business combination.

This investment opportunity is available exclusively to eligible investors receiving formal offering documents. This investment involves risks including but not limited to a.) no guarantee of post-SPAC trading price, b.) completion of the business combination agreement with a Nasdaq listing, and c.) related transaction and investment risks. See example term sheet <link> for further details.

Why Dot Ai

Our due diligence indicates Dot Ai’s impressive early market traction, driven by disruptive, patented asset and workflow management technology and AI-driven actionable insights. The company already boasts significant traction with enterprise customers, including a major partnership with Wurth that could generate $1B in revenue over the next 5 years. Additional customers such as Rooms 2 Go, Wagner Warehousing, and the U.S. Air Force are progressing toward adoption.

Dot Ai operates with a Capex-light, scalable SaaS business model. It combines passive asset-tracking hardware, some of which is built to purpose in its own factory in Puerto Rico, with real-time workflow management and actionable insights driven by proprietary AI technology. Dot Ai addresses significant inefficiencies in legacy asset management solutions, offering unprecedented speed and accuracy.

Below is investment documentation for Nevada Certified and SEC Accredited investors ready to take advantage of this opportunity

Annual Fee* = the round is expected to open, buy shares, distribute shares, and close within 120 days of opening, so the fees are expected to be for just one year.

Investment Highlights

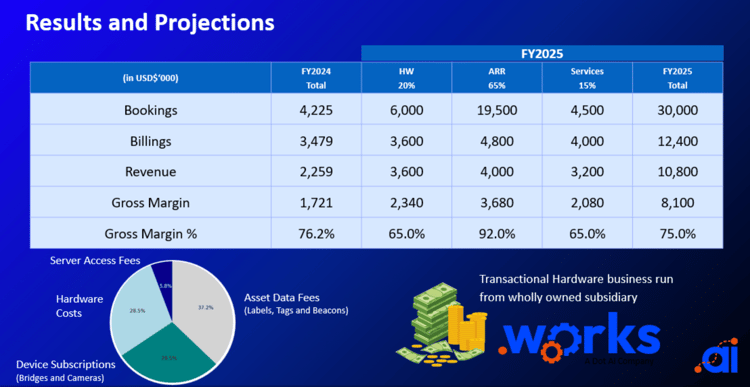

- Projected rapid revenue growth from a strong base of $2.2M revenue and $4.2M bookings in 2024.

- Patented technology integrating asset and workflow management, leveraging real-time AI insights.

- Robust initial market validation through large enterprise customers, highlighting substantial expansion potential.

- Proven leadership team with deep technical, operational, and industry-specific expertise.

- Significant competitive advantage through revolutionary speed of implementation (1-3 months versus industry average of 1-3 years).

- Organic growth strategy supported by a Capex-light model with high scalability and recurring SaaS revenue streams.

Traction

Market Opportunity

The global logistics and asset management industry is undergoing a transformative shift, driven by advances in AI, IoT, and cloud computing. Dot Ai’s platform is uniquely positioned within a $3.5 trillion market, addressing a serviceable available market (SAM) of $32 billion and an immediate serviceable obtainable market (SOM) of $3.6 billion. With its disruptive technology and rapid deployment capabilities (1-3 months vs. competitors' 1-3 years), Dot Ai is well-positioned to capture substantial market share rapidly.

Business Model

Dot Ai’s SaaS-based revenue model involves subscription fees combined with asset-tagging hardware, yielding high-margin, recurring revenue. Their patented, device-agnostic AI platform simplifies asset management and optimizes workflow in real-time, significantly reducing operational inefficiencies and implementation timelines (from 1-3 years down to 1-3 months).

Competitive Advantage

Dot Ai differentiates itself from competitors through patented AI-driven real-time data collection, actionable intelligence, and a dramatically simplified asset management ecosystem. Unlike competitors with fragmented solutions requiring significant infrastructure investments and lengthy deployments, Dot Ai’s solution is streamlined, rapidly deployable, and scalable.

Risks

- Adoption Pace: Customer transition from legacy systems to an innovative AI-driven platform may vary.

- Competitive Environment: Established competitors and new market entrants could create competitive pressure.

- Scaling: Achieving rapid growth requires meticulous execution in operations, sales, and customer success.

- Technological Execution: Reliance on ongoing technological innovation and execution could impact projected growth.

Register to Invest

About Us

Granite Partners and Ruby Partners operate the 1864 fund, FundNV, syndicate SPVs, and are for-profit venture capital funding partners with non-profit StartUpNV, Nevada's statewide business Incubator and Accelerator. FundNV invests in accelerator companies. AngelNV is an annual conference fund that educates new angels "how to" invest in Nevada startups. 1864 Fund is a seed fund focusing on startups in the American West. StartUpNV prepares early-stage companies for funding and accelerates them upon funding.

Contact Us

Las Vegas, NV 89101