Deal Memo

Publication Date: 01/10/2025

| TLDR: America's urgent need for reliable, cost-effective energy infrastructure has created a massive opportunity in project finance. BuildQ's AI-powered platform slashes project financing time by 70%, targeting a $12B market driven by fundamental energy demand. The BuildQ team boasts 30+ years of experience in project finance and 100+ years of experience in software engineering and product design. The team’s ability to execute quickly is evidenced by a $17M pipeline. FundNV2 is leading their $2M seed round, backed by Nevada state matching funds. Their 2% transaction fee model on all energy infrastructure projects positions us for potential 50x returns in this essential and growing market. |

FundNV 2 is leading BuildQ's seed round with a $100,000 investment. Through BQ Investors SPV, we're pooling up to $400k in additional capital for maximum impact. As lead investor, we've secured a matching investment of up to $500k from the State of Nevada SSBCI program – providing additional capital to accelerate BuildQ's growth while strengthening our investment position.

Why BuildQ

Our extensive due diligence revealed BuildQ's exceptional trajectory: Led by a Stanford- and Harvard-educated team with deep industry roots, they have already secured a $17M revenue pipeline. With proven leadership and innovative technology, they're positioned to capture significant market share. Our analysis confirms our required potential for 50x+ returns with successful execution. Furthermore, in much the same way as Uber grew their initial market to include segments not originally anticipated, we believe that BuildQ's project finance capabilities can be applied to other infrastructure and emerging energy projects, including nuclear.

Below are detailed diligence reports and investment documentation for Nevada Certified and SEC Accredited investors ready to take advantage of this opportunity

BuildQ Pitch

BuildQ is transforming renewable energy financing with its advanced project finance platform. By integrating AI-driven tools, software, and services, BuildQ overcomes the traditionally fragmented and costly process of developing, financing, and selling large-scale clean energy projects. Central to its innovation is the due diligence tool that functions much like legal shepardizing—enabling detailed review and validation of key assumptions across documents and data connections without automatically propagating changes. This ensures data integrity and simplifies the user's task to maintain consistency across linked documents, effectively reducing manual effort while providing users control over updates.

Operating in the burgeoning clean energy infrastructure market—expected to exceed $2 trillion by 2030—BuildQ facilitates financial modeling, AI-enhanced due diligence, and transaction management. Its lean 2% transaction fee model, applied to a range of project sizes from $10M to $100M and beyond, positions BuildQ for robust growth, targeting $10M in revenue over the next 18-24 months.

The massive opportunity to sell shovels in energy

The burgeoning clean energy infrastructure market is expected to exceed $2 trillion by 2030. BuildQ has the opportunity to become an early and critical player in the market to provide software infrastructure to the energy infrastructure market.

While BuildQ currently is an AI-powered platform to simplify project financing, we think they have a massive opportunity to become the OS (operating system) for clean energy. BuildQ is already building products and services to facilitate: 1) Financial modeling, 2) AI-enhanced due diligence, 3) Transaction management.

Integrating AI-driven tools, software, and services would let BuildQ bring massive efficiency to the traditionally fragmented and costly process of developing, financing, and selling large-scale clean energy projects.

One of its earliest products is an AI-enhanced due diligence tool, like a legal or energy analyst copilot — AI-assisted due diligence, risk analysis, key assumption review, and data management across documents. This product would solve an immediate pain point with energy development projects.

More importantly, BuildQ can land-and-grab more problems to solve for each client – all while building a deep data mote: upsell + data mote a la Salesforce.

In summary, strong veins:

- AI + space that’s typically not an early adopter = massive opportunity for B2B disruption

- Rising tide of unprecedented energy demand in US (growing more with AI-driven energy demands)

- Massive opportunity to become OS for clean energy development

- Data mote

With that said, it is early. The team is in the early days of discovery, rightly so, while building potential solutions for clean energy development. It’s likely the revenue model (currently: 2% transaction fee[1]), platform positioning (currently: simplified project financing), and go-to-market product and motion will change.

[1] The 2% transaction fee model, applied to a range of project sizes from $10M to $100M and beyond, would still position BuildQ for robust growth, targeting $10M in revenue over the next 18-24 months. And their 2% transaction fee model on all energy infrastructure projects positions us for potential 50x returns in this essential and growing market.

Founding Team

Maryssa Barron: Renewable energy market expert with over 8 years of experience, providing critical industry insights and connections to BuildQ. Licensed attorney in the District of Columbia.

Maryssa Barron: Renewable energy market expert with over 8 years of experience, providing critical industry insights and connections to BuildQ. Licensed attorney in the District of Columbia.

Robert Schmitt: Tech leader and founder with 40+ years of experience, bringing strategic vision and operational expertise to drive BuildQ’s platform development.

Robert Schmitt: Tech leader and founder with 40+ years of experience, bringing strategic vision and operational expertise to drive BuildQ’s platform development.

Mike Maddox: Software engineering leader with 30+ years of experience, ensuring the technical robustness and scalability of the platform.

Mike Maddox: Software engineering leader with 30+ years of experience, ensuring the technical robustness and scalability of the platform.

Annalisa Swank: UI/UX design professional with 15+ years of experience, focused on creating intuitive and user-friendly interfaces for BuildQ’s platform.

Annalisa Swank: UI/UX design professional with 15+ years of experience, focused on creating intuitive and user-friendly interfaces for BuildQ’s platform.

Fred Goldberg: Government and policy advisor, leveraging public sector expertise to align BuildQ’s offerings with regulatory frameworks and opportunities.

Fred Goldberg: Government and policy advisor, leveraging public sector expertise to align BuildQ’s offerings with regulatory frameworks and opportunities.

Harshan Jeyakumar: Project finance expert with 20+ years of experience and extensive networks in banking and renewables (CFA)

Harshan Jeyakumar: Project finance expert with 20+ years of experience and extensive networks in banking and renewables (CFA)

Eric Rochford: Full-stack software engineer with 7+ years experience scaling enterprise platforms from zero to one.

Eric Rochford: Full-stack software engineer with 7+ years experience scaling enterprise platforms from zero to one.

Go-To-Market Plan / Traction

- Early Traction: Over $17M in project pipeline,

- Pilot Projects: Entering 5-6 paid pilot engagements with developers, financiers, and law firms.

- Target Customers: Renewable energy developers, financiers, law firms, and policymakers.

- Expansion Goals: Grow the user base to include sufficient financiers and project developers on the path to closing pipeline revenue.

Market Background

The global clean energy infrastructure market is large and growing rapidly. BuildQ's market opportunity mirrors the evolution of transformative platforms like Uber, which expanded far beyond its initial black car service focus. While our conservative analysis identifies a compelling $12B TAM in renewable project finance, we believe this represents just the beachhead for BuildQ's technology.

Market Evolution Path

We are looking for the company's expansion potential to follow a clear progression:

- Current Market Validation

-

- Initial focus on renewable project finance, validated by $17M pipeline

- Proven demand through Texas ($400M) and California ($15M) portfolios

- Market Expansion Potential The broader infrastructure market opportunity expands through three key multipliers:

-

- 10-30% compound annual sector growth rate

- $20B additional opportunity from M&A/LBO transactions

- 3x potential from repeat financings

- Platform Evolution Just as Uber grew beyond ride-sharing into delivery, freight, etc., BuildQ's is positioned to expand into:

-

- Nuclear project financing

- Traditional infrastructure development

- Additional emerging energy sectors

BuildQ's immediate $12B TAM represents just the entry point. The platform's demonstrated ability to reduce financing time by 70% has applications across the entire $2 trillion infrastructure market, positioning the company to capture value well beyond its initial renewable energy focus.

NOTE: BuildQ's market opportunity reflects the evolution of transformative platforms that scale far beyond their initial focus. Our conservative analysis, as shown in the Market Background, identifies a $12B TAM in renewable project finance, validated by a $17M pipeline and proven demand in Texas ($400M) and California ($15M) portfolios. This represents the initial market for BuildQ’s technology. However, Maryssa’s broader research, shown in the image in Market Opportunity, highlights the expansive $2 trillion clean energy infrastructure market projected by 2030, supported by 10-30% sector growth rates, $20B in M&A and LBO opportunities, and 3x potential from repeat financings. BuildQ’s AI-powered platform, which reduces financing time by 70%, is uniquely positioned to expand into nuclear project financing, traditional infrastructure development, and emerging energy sectors. While the $12B TAM marks a strong entry point, BuildQ’s platform has the capability to capture significant value across the broader clean energy and infrastructure markets as it scales.

Business Model

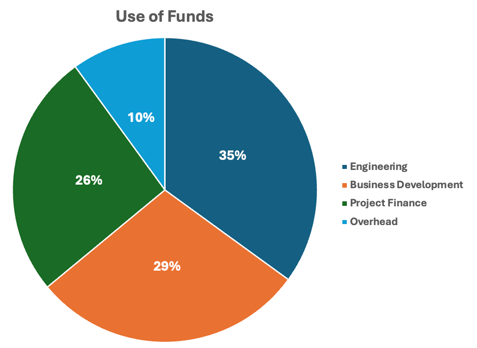

BuildQ operates on a 2% transaction fee model, aligning incentives while reducing upfront costs for users. This model applies to tax equity, construction financing, and debt/grant arrangements. The platform also plans to generate additional revenue through SaaS offerings.

Initial Target Markets (from pipeline):

- Texas: $400M solar + storage portfolio

- California: $15M solar + storage portfolio

Competitors

BuildQ's key competitors include:

- Banyan Infrastructure: Focuses on distributed energy projects; BuildQ offers broader solutions for larger-scale projects.

- Conductor Solar: Specializes in solar financing, whereas BuildQ supports diverse renewable energy projects.

- LevelTen Energy: Primarily a marketplace for PPAs, lacking BuildQ’s comprehensive financing tools.

- Competitive Advantage: BuildQ integrates software, AI, and services into a single platform, offering unparalleled efficiency and cost savings compared to competitors' fragmented solutions.

Risks

- Market Adoption: Requires a shift from traditional financing methods.

- Regulatory Uncertainty: Dependent on government policies and incentives.

- Scaling Challenges: Early-stage traction without confirmed revenue could impact growth.

- Competition: Established players and new entrants could pose challenges.

Due Diligence Report

Click here to view full report

Register to Invest

About Us

Granite Partners and Ruby Partners operate the 1864 fund, FundNV, syndicate SPVs, and are for-profit venture capital funding partners with non-profit StartUpNV, Nevada's statewide business Incubator and Accelerator. FundNV invests in accelerator companies. AngelNV is an annual conference fund that educates new angels "how to" invest in Nevada startups. 1864 Fund is a seed fund focusing on startups in the American West. StartUpNV prepares early-stage companies for funding and accelerates them upon funding.

Contact Us

Las Vegas, NV 89101