1864 Fund

Top 1% Seed Stage Fund Performance

Capital-efficient B2B investing in emerging US ecosystems with proven track record of superior returns and fast liquidity

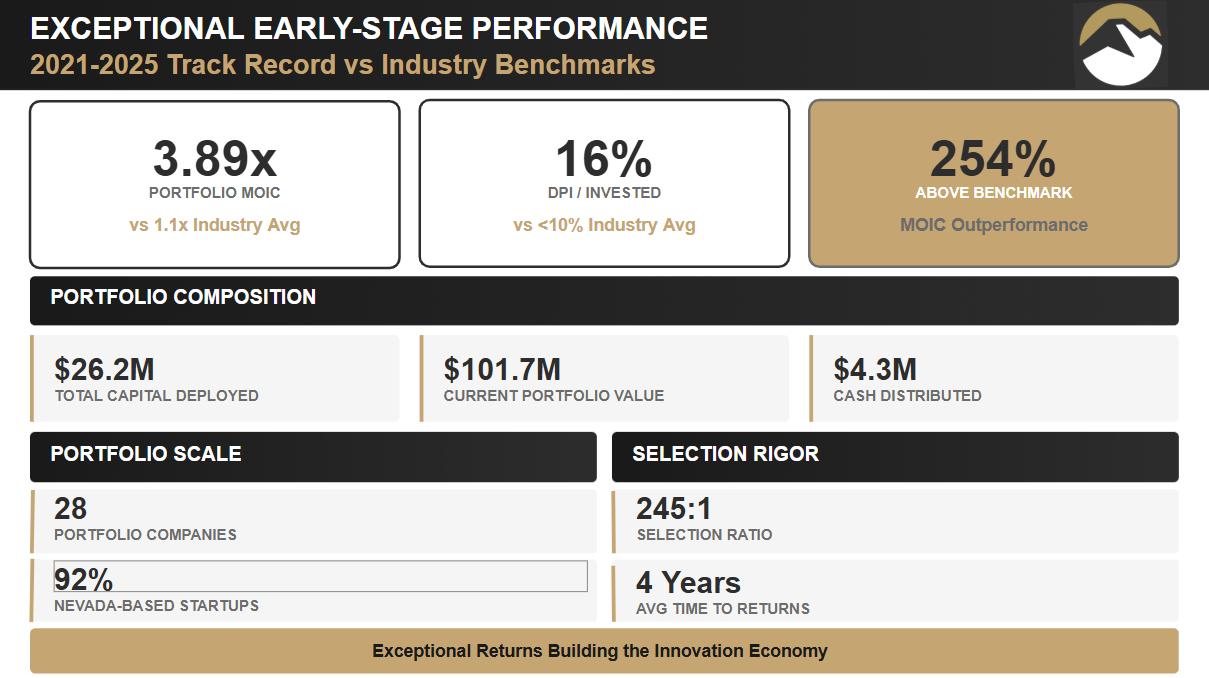

3.89x

Portfolio Returns

16%

Already Distributed

4 Years

Average Time to Returns

Our Track Record: $26.2M -> $101.7M

While 90% of 2021-vintage funds show zero distributions, we've already returned $4.3M to LPs with significantly more in the pipeline.

Portfolio Momentum

1864 Portfolio (6 Companies)

Voltaire (Voltaire.claims)

Turning 30-minute insurance claims letters into 30-second AI-powered outputs with 200%+ first-year ROI

Lucihub (lucihub.com)

Transforming smartphone footage into professionally edited videos in hours, not weeks—powered by expert editors + AI

Tilt (tilt.ai)

AI-driven freight platform disrupting the $6T logistics market with real-time visibility, predictive routing, and sustainability at scale.

ZenCentiv (zencentiv.com)

Automating sales commission calculations to eliminate errors, reduce disputes, and free finance teams from manual spreadsheet hell

Armentus (armentus.com)

Patented 8-second teat prep system cutting dairy farm costs by thousands monthly while reducing mastitis and boosting milk quality.

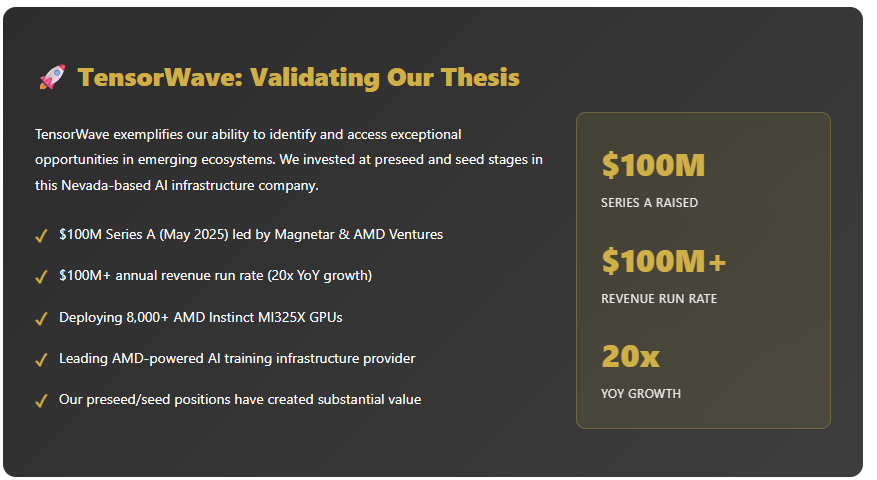

Tensorwave (tensorwave.com)

AMD-powered AI cloud with 8,000+ liquid-cooled GPUs—delivering breakthrough performance-per-dollar at $100M+ run rate. (10% of fund)

Investment Strategy

What We Look For

- Capital-efficient B2B and enterprise high-tech solutions companies

- $500K-$2.5M rounds at mid-seven-figure valuations

- Monthly recurring revenue growing 10%+ with low churn

- Full-time, experienced founders with domain expertise

- Target: 50x returns over 10 years (or 25% IRR for faster exits)

- All investments QSBS qualified for tax advantages

How we invest

- Lead rounds: $500K checks with board seat or observer rights

- Follow trusted partners: $250K checks in syndicated rounds

- Target returns: 50x over 10 years (25% IRR or better)

- Follow-on capital: Via SPVs for portfolio winners, allowing LP selectivity

- Active support: recruiting, customer intros, accelerator, Las Vegas co-work offices & demo facility for industry conferences

Former Operators, Not Tourists

Our Managing Partners are experienced founders and executives who've built, scaled, and exited companies. We're operators who've been on both sides of the table—which is why we can identify exceptional founders and help them succeed.

Supporting team: 2 Partners, 1 Principal, 1 Analyst providing depth in deal sourcing, due diligence, and portfolio support

7

Successful Exits

28

Portfolio Companies

245:1

Selection Discipline

Fund Status & Opportunity

Join us in capitalizing on the best seed investing environment in over a decade

TARGET SIZE

$10M

First institutional seed fund

DEPLOYED

$2.9M

6 Portfolio Companies

TIMELINE

Q1 2026

Target Final Commitments

Our early deployment demonstrates active deal flow and gives new LPs the ability to evaluate actual portfolio performance—including TensorWave's exceptional growth trajectory—rather than projections alone.

Investment Terms

MINIMUM INVESTMENT

$50K

MAXIMUM INVESTMENT

$2M

MANAGMENT FEE

2%

PERFORMANCE CARRY

20%

Structure: Nevada Series LLC managed by Granite Partners LLC

Qualification: Accredited Investors and Qualified Purchasers

Tax Advantage: All investments QSBS qualified for potential capital gains exclusion

LP Alignment: Management Fee billed annually. 100% capital invested, avoiding the 20% withhold (2%/yr x 10 yrs) seen in most VC funds.

Ready to Join Top 1% Performance?

Schedule a call to discuss joining our next closing and accessing our proven seed-stage strategy

For more information, contact: jeff@1864.fund

The 1864 Fund | Managed by Granite Partners LLC

Copyright 2026