1864 Fund

A $10M seed fund focused on capital efficient opportunities in emerging ecosystems in the US

The 1864 Fund | Investment Memo

With $10M earmarked for seed-stage investments, the 1864 Fund is championing the growth of nascent enterprises and visionary founders. Anchored in the vibrant hub of Las Vegas, our fund enjoys direct connections to more US cities than anyplace else, positioning us at the heart of opportunity. As we've done in our hometown and state with our previous funds, we will reach out to unearth the potential in underserved capital markets. In collaboration with local economic development like our partners at StartUpNV, we find the hidden gems—ambitious founders and startups nestled in the heart of America.

Our primary focus is on highly scalable, capital-efficient, technology-based startups that serve large B2B and Enterprise markets. We prioritize ventures led by tenacious founders with unique insights and experience. The technical solutions provided by these startups must offer highly valued, essential solutions that customers cannot do without. Our preferred entry point is rapid sales growth of 10% per month, with very low customer churn and at least $500,000 in recurring revenue.

The 1864 Fund leads investment rounds with checks ranging from $350K to $500K, targeting fundraising efforts of $500K to $2.5M. Additionally, we engage in syndication, backing trusted partners with $100K to $200K investments to diversify our portfolio and mitigate the inherent risks of early-stage funding.

Fund Target

$10,000,000

Fees

- 2% Annual Management

- 20% Performance / Carry

Investment

- $50,000 (minimum)

- $2,000,000 (maximum)

Investor Criteria

- Accredited Investor

- Qualified Purchaser

Seed Stage Disrupted | Best Investing in a Decade+

In 2023, despite many Seed and A-Round investors pulling out or slowing down, we have witnessed a remarkable surge in innovation. The crash in zero interest rate policy (ZIRP) valuations has opened up unprecedented opportunities reminiscent of investments after the 'Great Recession' and the Internet 'Bubble Burst.' We are seizing this moment by investing in exceptional startups in expansive markets, defying the ZIRP trend, and securing advantageous terms. Notably, our portfolio valuation has soared by 3x in just three years. We are confident that this trend will persist, ensuring that our capital remains competitive and influential for ambitious seed-stage founders and pioneering companies. We foresee a flourishing environment for new company formation, especially in tandem with a contracting labor market.

With our prior fund fully invested, we are raising a larger fund to capitalize on this once-in-a-decade opportunity. Join Granite Partners and invest in 1864.Fund and be a part of this exciting, profitable journey.

Startups of the Great Recession era 2007 to 2014 .... When modest seven-figure entry valuations returned 500x to 5000x to seed investors

A Track Record to NV

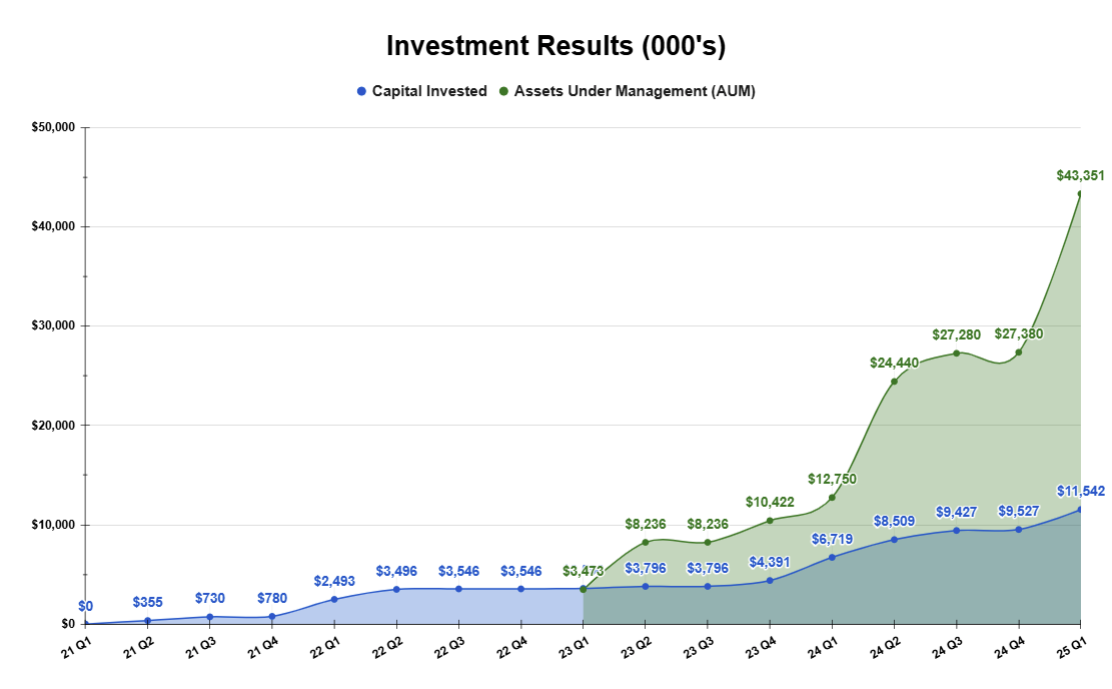

While 1864 is our newest fund, the fund's managing partnership, Granite Partners, is familiar. Since 2021, Granite Partners (GP) has invested $12M, making 38 tranched investments in 24 startups. GP's managed funds and syndicate include 300+ unique high-net-worth investors. GP has formal partnerships with the StartUpNV accelerator and the State of Nevada's SSBCI program that matches our Nevada investments 1:1. Additionally, seven venture funds and multiple angel groups have followed our lead since 2021, adding $23M to our direct investments. The chart below shows our direct investing history and current portfolio valuations, including mark-to-market adjustments down when companies stumble or fail - and up when unrelated venture firms invest at higher valuations. All market adjustments are post-ZIRP.

How 1864 looks at opportunities

What we like:

- Subscriptions and recurring revenue

- Highly scalable tech in huge B2B / enterprise markets

- Practical application of emerging tech (AI, web3, decentralization)

- Marketplaces with hard-to-secure inventory

- Capital efficiency / non-dilutive funding

- Full-time founders

Bonus:

- Intellectual Property / Patents / Trade Secrets

- Team: deep or relevant experience/expertise and balanced skillsets

- Team: prior experience raising and returning capital to investors

- Traction: Sales @ $40k -$50K MRR (growing @ 10%+ monthly)

What we don't like:

- Companies with messy or sloppy cap tables

- Capital-intensive/deep science businesses

- Coins/Tokens/NFTs of limited practical utility

- Consumer Packaged Goods, Food, or Supplements

- Lifestyle businesses – restaurants, salons, gyms

- “Tarpit” business – idealist founders approaching ambitious markets with no competitive advantage or differentiation

- Non-U.S. Corps (with minimal exceptions)

- Prior priced rounds with highly aggressive terms (for investors or founders)

- Teams, Leagues, Festivals, Events or Productions

Why we invest

- The company has demonstrated initial market validation and line-of-sight to sales >$500K annually

- Our money is part of a meaningful part of a larger round supported by financial growth of company.

- The company has made efficient use of capital through a novel approach or product.

- The founders are committed, determined, and leaders among their peers.

- The problem/solution addresses (or will create) a large TAM / SAM with an achievable and practical SOM.

- The deal has a realistic and reasonable valuation supported by the company's progress and industry comps.

How we invest

- Checks $150K -$500K

- Seed Rounds $500K -$2.5M, depending on valuation

- Achievable exit scenarios returning 50x per investment (2X fund size)

- The deal has a realistic and reasonable valuation supported by the company's progress and industry exit comparables.

- Lead where appropriate, with board seat and neutral board

- Every opportunity QSBS qualified

- Target 1864 ownership: 5%, deal dependent (as part of round size for 15%-20%, valuation target in mid-seven figures)

- "Dream Deal": $1M round with $5M valuation (20%) for a company in a large market with founders who can execute and current run rate of $500k in annual recurring sales, growing at 10% or more month over month.

1864 Granite Partners

Spanning the Boomer, GenX, and Millennial generations, our partners are former operating founders with seven successful exits, an eye for driven founders with scalable startups in large markets, and the discipline to invest at the right entry valuation with win-win terms.

Legal Formation

The 1864 Fund is a Nevada series LLC and is managed by General Partner, Granite Partners LLC, also a series LLC. Both series LLCs are organized in Nevada under Western Frontier Master LLC. Limited Partners will be members of the 1864 Series LLC and will own a pro-rata share of the fund based on their investment amount and the fund size. Fund Fees are the industry standard 2/20. The investment range is $50k minimum up to 20% of the fund ($2M). Accredited Investors and Qualified Purchasers may invest.

Copyright 2022-25